Introduction - Spread Rate

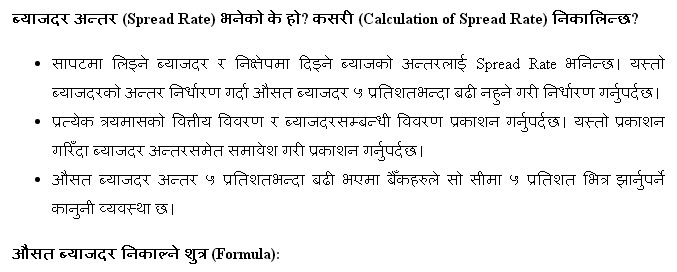

Net interest spread refers to the distinction in acquiring and loaning rates of monetary organizations, (for example, banks) in ostensible terms. ... Net premium spread is communicated as premium yield on winning resources (any advantage, for example, an advance, that creates intrigue salary) short loan fees paid on obtained reserves. Net premium spread is like net premium edge; net premium spread communicates the ostensible normal contrast amongst acquiring and loaning rates, without making up for the way that the measure of winning resources and obtained assets might be extraordinary.

The net loan fee spread is the contrast between the normal yield a monetary establishment gets from advances and other enthusiasm accumulating exercises and the normal rate it pays on stores and borrowings.

No comments:

Post a Comment