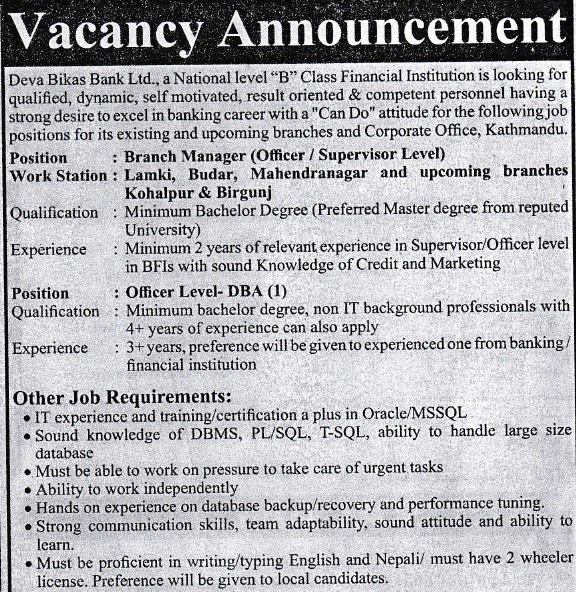

Original Vacancy Notice

Introduction - Deva Bikas Bank Limited

Deva Bikas Bank Limited, B class budgetary organization authorized by Nepal Rastra Bank, rose after fruitful merger between NDEP Development Bank Limited and Rising Development Bank in 2015 and began its joint activity from tenth July, 2015. NDEP Development Bank Limited, advanced by a consortium of unmistakable officials, eminent identities from the business segment, Employees Provident Fund (Karmachari Sanchaya Kosh), people and organizations with nearby roots however from various strolls of existence with a dream and commitment to give the best budgetary items and administrations in the most proficient and expert way began its managing an account tasks from the year 2006 as a national level improvement bank under the Banks and Financial Institutions Act 2063. Another accomplice to the merger, Rising Development Bank,promoted by a consortium of unmistakable civil servants, famous identities from the business segment from Chitwan, Nawalparashi and different distticts, began it activity since 2006 as provincial level improvement bank. With this merger, the bank have a paid up capital of 818 million rupees, 36 branch workplaces and Service Centers and 9 ATMs spread all over the nation. It takes pride in having its own working for its Head and Corporate Office in Lal Durbar Marg, Kathmandu.

- Endeavor to shield and advance the rights and welfare of the considerable number of contributors and investors by giving the best and most solid administrations

- To assemble assets from interior and outside hotspot for the foundation, advancement, development, limit improvement and inspiring of farming, industry, administrations, exchange and other potential beneficial segments.

- To use accessible expertise, labor and capital for the foundation, task, improvement, extension of beneficial business in Urban and Rural zones. Helps on work creation and destitution end through supply of monetary instrument, specialized and proficient consultancy and trainings.

- To gather scattered cash-flow to make corporate speculation and render budgetary middle person benefit through sound rivalry.

Capital

- Authorized Capital : Rs. 2,500.000 million

- Issued Capital : Rs. 1,633.277 million

- Paid up Capital : Rs. 1,633.277 million

Capital Structure

- Promoters Share : 51.00%

- Open Share : 49.00%

No comments:

Post a Comment